By Frank Meke

Nigeria’ s ease of doing business rating recently fell like the philistines god, Dagon, with legs, hands, heads, and limbs shattered and unfixable.

Instead of generating refreshing transformations and opportunities, Nigeria’s ease of doing business environment, gave birth to earth worms, with the most stunning ability to frustrate businesses, particularly small-scale enterprises in transportation, hospitality, catering, and tourism.

Even medical tourism enterprises are circled by mutant taxes and levies, with rising preventable deaths.

No doubt, multiplicity of taxes and levies have continued to fuel the poor returns on investment in tourism trade activities, nipping employment and growth potentials of the sector, with industry players across the entire gamut of economic ecosystem, shouting and praying on Mount carmel for fire to fall on their oppressors.

Sadly, those who should protect and help with tax rebates and other palliatives cleverly chose to wash their hands off the impending doom, asking those burdened by the tax and levies regimes to go to court.

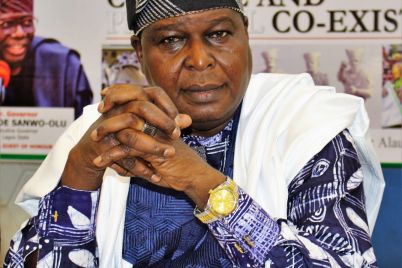

A few weeks ago, President, Federation of Tourism Associations of Nigeria, ( ftan) Mr Nkereweum Onung in response to back door powered enactments of Nigeria Tourism Development Authority ( NTDA) and National Institute for Hospitality and Tourism Studies acts, constituted a legal review committee, to go through the provisions of those instruments and advice how it affects the growth and survival of the industry and practitioners in particular.

Ftan boss may possibly be on the drive to ambush or work around the sections of the two regulations, which, from all indications, targets the private sector, using stings of registration, classification, and grading to chop off the necks of struggling and strangulated operators.

Indeed, in Nigeria, every entrepreneur goes through various tax circles such as company income tax, stamp duty tax, value added tax , personal income tax , TV and radio licences, Pencom tax and many more, the fear however of about 17 other bills on levies pending planery approvals at the national assembly, seem to precipitate goose pimple among industry practitioners.

Today, it is no longer news that most eateries, holiday or recreation apartments, and hotels are blind on Goggle location applications because of rising signage fees.

In lagos, Abuja, Owerri, Aba, and in most state capitals across Nigeria, industry players are made to cough out very ridiculous amounts of money as levies such as underground water tax, environmental pollution fees, property fencing fees, Generator usage fees, land use charge, Building renovation permits, liquor licence fees, and parking fees.

Instead of creating an atmosphere for investment growth and employment generation opportunities, the multiplicity of taxes and levies have sent most operators and their businesses to the intensive care unit of unbridled government poor ease of doing business environment cemeteries.

While federal government and state governments agencies and ministeries blossom and live big off the pains of the taxes and levies from the private sector, business owners in Nigeria live on drips and malaria drugs with no sign of coming out of depression alive.

Significantly, statistics on impart assessment of these unfriendly and obnoxious levies are scarce to come by , ditto well informed economic growth potentials ratings which could encourage and attract both local and international investors.

Like blind Bartimaeus, operators’ daily lamentations hardly ever attract the attention of the oppressive government regulatory agencies, and in most cases, their hired thugs passed off as tax consultants cheekily force helpless business owners to fast and pray.

While hospitality and catering businesses which cannot afford customs duties imposed on the imported foreign trade equipment, with most resorting to local fabrications to remain in business, that road however to Damascus is also being riddled with levies pot holes as cost of production, rising electricity bills and cost standardisation ecosystem, may close down the local fabrication market.

Taxis, car hire, and logistics companies are daily confronted by government licensed thugs in uniforms, arm twisting, and sometimes taking laws into their hands in the execution of tax and levies targets, usually executed by road sides, junctions and highways.

Government ombudsman agencies pretend when the high handness and excessiveness of regulatory agencies are brought to their notice, justifying the saying that the fetish priest can not cure the diseases imposed by his master, the devil.

Honestly, it is an understatement to say taxes and levies have continued to undermine business growth in the industry but also have led to the abortion of dreams of Nigeria as a prime tourism destination.

Funny enough, Nigeria and its federating states have done nothing sustainably to aid development and job creation openings with the huge money realised from the multiplicity of taxes and levies generated year by year, except growing fat on the corruption and stealing of same unholy resources.

Like the sign of Jona, there are no signs of rainbow in the sky for industry players as this government drops off the crown of leadership on 29th of May, 2023.